All Categories

Featured

Nonetheless, these plans can be much more intricate compared to other kinds of life insurance, and they aren't necessarily best for each investor. Speaking with a skilled life insurance coverage representative or broker can aid you determine if indexed global life insurance policy is an excellent suitable for you. Investopedia does not offer tax obligation, financial investment, or financial solutions and advice.

, adding an irreversible life policy to their investment portfolio might make sense.

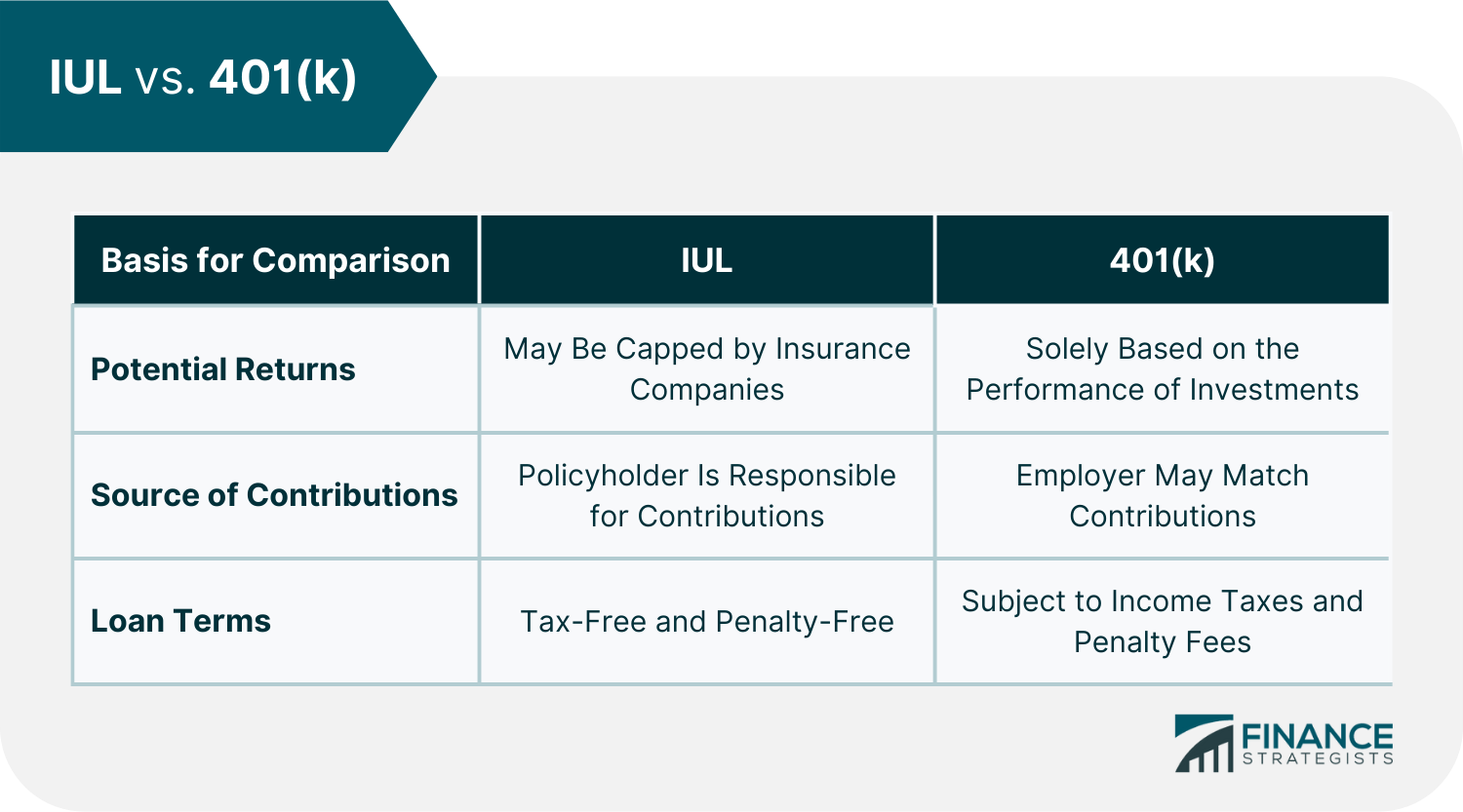

Low rates of return: Recent study located that over a nine-year period, staff member 401(k)s grew by an average of 15.6% per year. Contrast that to a fixed interest rate of 2%-3% on an irreversible life plan. These distinctions accumulate in time. Applied to $50,000 in financial savings, the charges over would certainly equate to $285 each year in a 401(k) vs.

In the exact same capillary, you could see financial investment growth of $7,950 a year at 15.6% passion with a 401(k) contrasted to $1,500 per year at 3% passion, and you would certainly invest $855 more on life insurance policy each month to have whole life insurance coverage. For many people, obtaining irreversible life insurance as part of a retirement is not a great idea.

Indexed Universal Life Insurance Vs Roth Ira: Which Is Better For Your Retirement Plan?

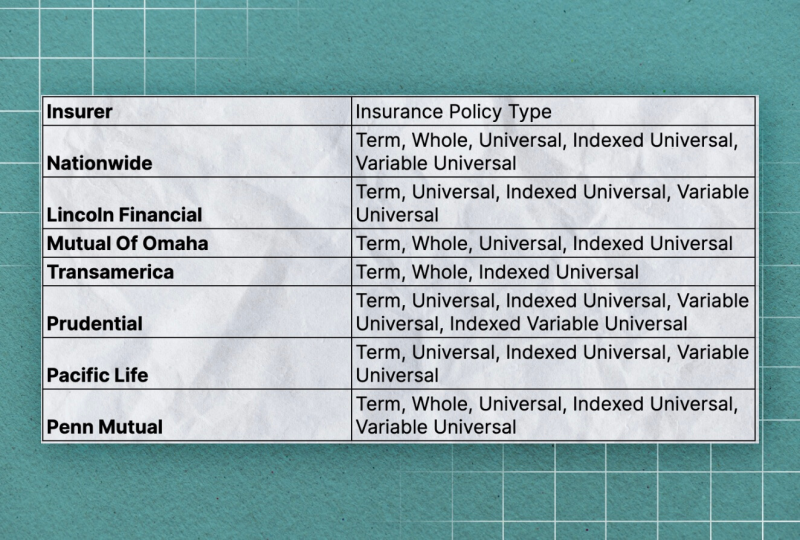

Below are two usual kinds of long-term life plans that can be made use of as an LIRP. Whole life insurance policy offers fixed premiums and money worth that grows at a set price established by the insurance firm. Conventional financial investment accounts generally use higher returns and more flexibility than whole life insurance, however whole life can give a reasonably low-risk supplement to these retired life savings techniques, as long as you're positive you can afford the premiums for the lifetime of the policy or in this case, until retired life.

Latest Posts

Universal Life Insurance Ratings

Iul Life Insurance Reviews

Universal Life Quotes