All Categories

Featured

IUL contracts secure versus losses while using some equity risk premium. IRAs and 401(k)s do not offer the very same drawback security, though there is no cap on returns. IULs often tend to have actually have complicated terms and greater charges. High-net-worth individuals looking to reduce their tax obligation worry for retirement may benefit from investing in an IUL.Some capitalists are better off getting term insurance while optimizing their retirement payments, as opposed to acquiring IULs.

While that formula is connected to the performance of an index, the quantity of the credit is virtually always going to be much less.

With an indexed global life policy, there is a cap on the amount of gains, which can limit your account's development. If an index like the S&P 500 increases 12%, your gain can be a fraction of that amount.

Wrl Iul

Unalterable life insurance depends on have long been a preferred tax obligation sanctuary for such people. If you fall under this classification, take into consideration speaking to a fee-only monetary expert to go over whether getting long-term insurance coverage fits your general approach. For lots of capitalists, though, it might be far better to max out on contributions to tax-advantaged pension, specifically if there are contribution matches from an employer.

Some plans have actually a guaranteed rate of return. Among the crucial features of indexed universal life (IUL) is that it gives a tax-free distributions. It can be a valuable tool for financiers who want options for a tax-free retirement. Typically, monetary advisors would certainly suggest contribu6ting to a 401(k) before an IRA specifically if your employer is providing matching payments.

Suitable for ages 35-55.: Offers flexible insurance coverage with moderate cash value in years 15-30. Some things clients must consider: In exchange for the fatality advantage, life insurance coverage products bill fees such as death and expense threat fees and surrender charges.

Retired life preparation is crucial to maintaining monetary safety and preserving a details standard of life. of all Americans are stressed over "maintaining a comfortable standard of life in retired life," according to a 2012 survey by Americans for Secure Retirement. Based on current data, this majority of Americans are justified in their worry.

Division of Labor approximates that a person will certainly need to preserve their current standard of living once they start retirement. Additionally, one-third of U.S. homeowners, between the ages of 30 and 59, will certainly not have the ability to maintain their criterion of living after retired life, even if they postpone their retirement up until age 70, according to a 2012 study by the Fringe benefit Research Study Institute.

Iul Illustration

In the same year those aged 75 and older held a typical debt of $27,409. Alarmingly, that number had more than increased since 2007 when the ordinary financial obligation was $13,665, according to the Staff member Benefit Research Institute (EBRI).

Demographics Bureau. 56 percent of American retired people still had superior financial debts when they retired in 2012, according to a survey by CESI Financial obligation Solutions. What's even worse is that past study has shown financial debt among retired people has been on the surge throughout the previous few years. According to Boston University's Center for Retired life Study, "In between 1991 and 2007 the number of Americans in between the ages of 65 and 74 that declared insolvency raised an unbelievable 178 percent." The Roth Individual Retirement Account and Plan are both tools that can be used to construct significant retired life savings.

These economic devices are comparable in that they benefit insurance holders who want to create financial savings at a reduced tax rate than they may run into in the future. The policy expands based on the interest, or returns, credited to the account - Indexed universal life insurance vs 401k.

That makes Roth IRAs perfect savings cars for young, lower-income employees that live in a lower tax obligation bracket and who will certainly gain from years of tax-free, compounded development. Considering that there are no minimum needed contributions, a Roth individual retirement account offers financiers regulate over their individual goals and take the chance of tolerance. In addition, there are no minimum called for distributions at any age during the life of the plan.

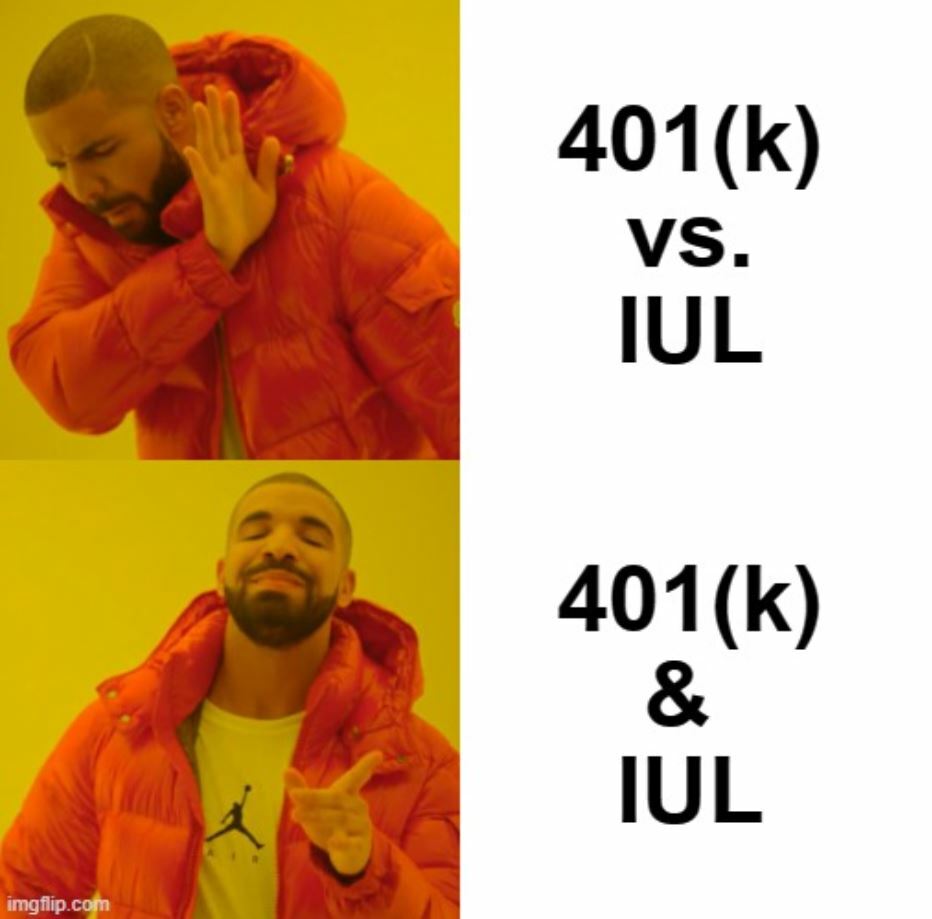

To compare ULI and 401K strategies, take a minute to understand the basics of both items: A 401(k) lets employees make tax-deductible contributions and take pleasure in tax-deferred development. When employees retire, they typically pay tax obligations on withdrawals as common revenue.

Iul Vs 401k Tax Advantages

Like other irreversible life policies, a ULI policy also allocates component of the premiums to a cash account. Since these are fixed-index policies, unlike variable life, the policy will additionally have actually an ensured minimum, so the money in the cash account will not decrease if the index decreases.

Policy owners will certainly additionally tax-deferred gains within their cash money account. They may also appreciate such various other financial and tax obligation advantages as the capability to obtain against their tax obligation account as opposed to withdrawing funds. Because means, universal life insurance policy can work as both life insurance policy and a growing possession. Discover some highlights of the advantages that universal life insurance policy can supply: Universal life insurance policies don't impose restrictions on the dimension of plans, so they might supply a means for workers to save more if they have actually currently maxed out the IRS limits for other tax-advantaged financial products.

The IUL is much better than a 401(k) or an IRA when it comes to conserving for retirement. With his almost 50 years of experience as a monetary planner and retirement planning professional, Doug Andrew can show you specifically why this is the situation.

Latest Posts

Universal Life Insurance Ratings

Iul Life Insurance Reviews

Universal Life Quotes