All Categories

Featured

Table of Contents

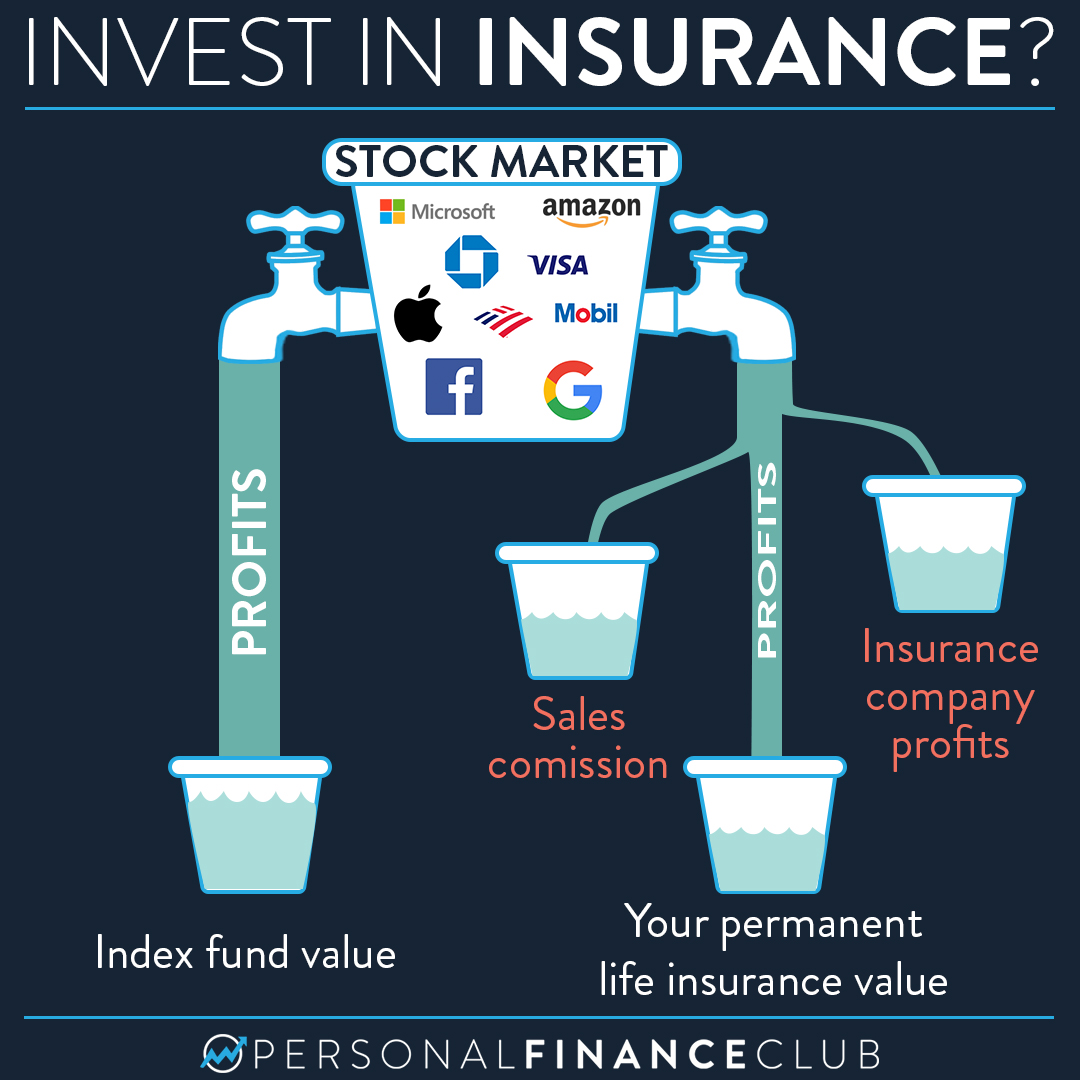

It's essential to keep in mind that your cash is not directly invested in the securities market. You can take money from your IUL anytime, yet fees and surrender costs may be connected with doing so. If you need to access the funds in your IUL policy, evaluating the pros and cons of a withdrawal or a funding is essential.

Unlike straight financial investments in the stock exchange, your money value is not straight bought the underlying index. Can I Use IUL Instead of a 401(k) for Retirement?. Instead, the insurer uses financial instruments like choices to link your cash value development to the index's performance. Among the distinct functions of IUL is the cap and flooring prices

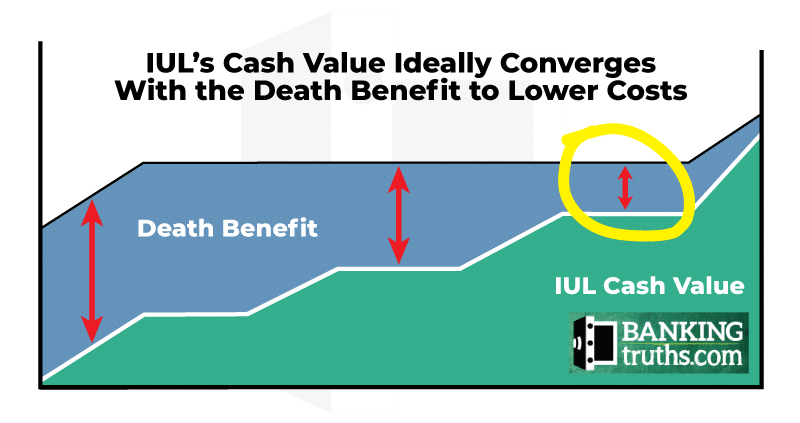

The death benefit can be a fixed amount or can include the cash money value, depending on the policy's structure. The money worth in an IUL policy grows on a tax-deferred basis.

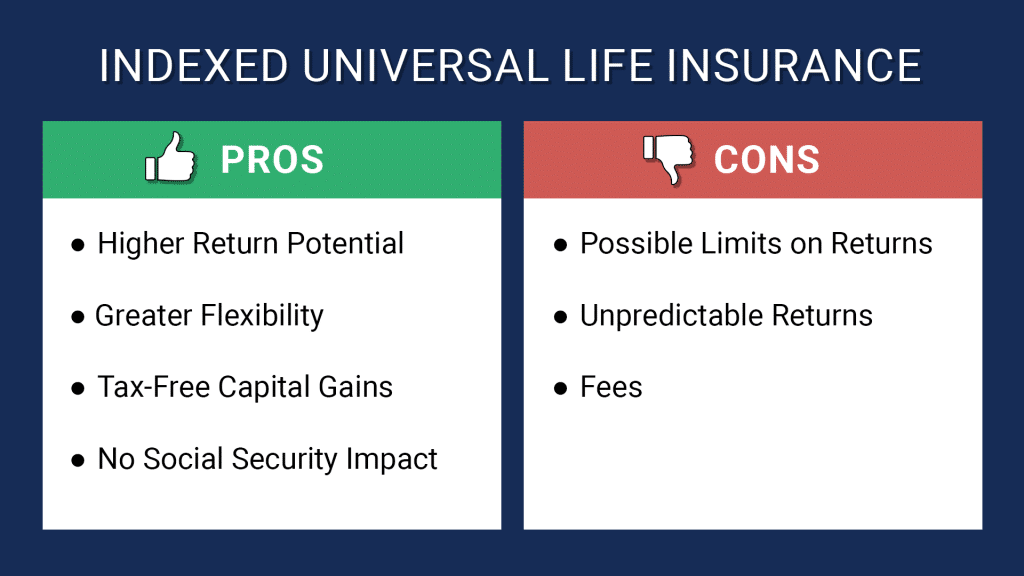

Always assess the plan's details and talk to an insurance professional to completely recognize the advantages, limitations, and costs. An Indexed Universal Life Insurance plan (IUL) provides a special blend of attributes that can make it an appealing choice for specific people. Here are several of the crucial benefits:: One of one of the most attractive elements of IUL is the possibility for higher returns compared to various other kinds of irreversible life insurance policy.

Withdrawing or taking a lending from your plan may reduce its money value, fatality benefit, and have tax obligation implications.: For those interested in heritage preparation, IUL can be structured to supply a tax-efficient way to pass wide range to the future generation. The survivor benefit can cover inheritance tax, and the money worth can be an additional inheritance.

Why Iuls Are Gaining Popularity As An Alternative To 401(k) Plans

While Indexed Universal Life Insurance Policy (IUL) offers a variety of benefits, it's vital to think about the possible drawbacks to make an informed choice. Right here are several of the vital drawbacks: IUL policies are much more complicated than typical term life insurance policy plans or whole life insurance policy plans. Recognizing exactly how the cash money worth is linked to a supply market index and the implications of cap and floor rates can be testing for the ordinary customer.

The costs cover not just the expense of the insurance policy however likewise administrative fees and the investment element, making it a costlier option. While the cash worth has the capacity for growth based on a securities market index, that growth is often topped. If the index executes extremely well in a given year, your gains will be restricted to the cap price specified in your plan.

: Adding optional functions or motorcyclists can enhance the cost.: Just how the policy is structured, consisting of how the money worth is alloted, can also impact the cost.: Different insurer have various pricing versions, so looking around is wise.: These are charges for managing the policy and are normally subtracted from the cash worth.

Words Ending In Iul

: The expenses can be similar, however IUL supplies a floor to assist safeguard versus market declines, which variable life insurance policy plans typically do not. It isn't simple to offer a specific expense without a certain quote, as costs can differ considerably in between insurance coverage providers and private circumstances. It's crucial to stabilize the relevance of life insurance policy and the demand for included security it provides with potentially greater costs.

They can help you understand the prices and whether an IUL plan aligns with your financial goals and needs. Whether Indexed Universal Life Insurance Policy (IUL) is "worth it" is subjective and depends upon your economic objectives, risk tolerance, and long-lasting planning demands. Right here are some points to take into consideration:: If you're seeking a long-lasting investment vehicle that provides a death advantage, IUL can be a great alternative.

(IUL) policy. Recognizing the distinction in between IUL vs. 401(k) will certainly help you prepare successfully for retired life and your family's financial health.

Iul University

In this instance, all withdrawals are tax-free given that you've currently paid taxes on that income. When you die, the funds in your 401(k) account will be transferred to your beneficiary. If you do not assign a recipient, the money in your account will enter into your to repay any type of impressive financial debt.

You might grow your Roth IRA account and leave all the cash to your beneficiaries. On top of that, Roth IRAs use more investment options than Roth 401(k) plans. Your only options on a Roth 401(k) strategy are those used by your strategy service provider with.The drawback of a Roth IRA is that there's an income limit on that can contribute to an account.

Given that 401(k) strategies and Index Universal Life Insurance feature in different ways, your cost savings for each depend on unique aspects. When contrasting IUL vs. 401(k), the initial action is to recognize the overall purpose of retirement funds compared to insurance coverage advantages.

You must estimate your retired life needs based on your existing income and the requirement of living you wish to maintain throughout your retired life. Generally, the cost of living doubles every 20 years. You can utilize this rising cost of living calculator for even more precise results. If you find 80% of your current yearly income and multiply that by 2, you'll get a quote of the quantity you'll require to survive if you retire within the next twenty years.

If you withdraw approximately 4% of your retirement revenue annually (taking into consideration inflation), the funds must last regarding 30 years. On the contrary, when contrasting IUL vs. 401(k), the worth of your Index Universal Life Insurance coverage plan depends on factors such as; Your present revenue; The estimated expense of your funeral service expenses; The dimension of your family; and The earnings streams in your house (whether somebody else is used or not).

Iscte Iul Fenix

Actually, you don't have much control over their allocation. The primary purpose of permanent life insurance policy is to provide additional financial backing for your family after you pass away. You can withdraw cash from your money worth account for individual requirements, your insurance policy provider will deduct that amount from your fatality benefits.

A 401(k) provides earnings security after retired life. Each offers a various function. That's not to state you require to select in between IUL vs. 401(k). You can have both an Index Universal Life insurance policy policy and a 401(k) pension. You should recognize that the terms of these policies change every year.

Prepared to begin? We're right here for you! Reserve a complimentary consultation with me now!.?.!! I'll respond to all your concerns concerning Index Universal Life Insurance Policy and how you can attain wide range prior to retired life.

Table of Contents

Latest Posts

Universal Life Insurance Ratings

Iul Life Insurance Reviews

Universal Life Quotes

More

Latest Posts

Universal Life Insurance Ratings

Iul Life Insurance Reviews

Universal Life Quotes